Home, A Loan: The Blog > Lower your monthly payments without refinancing? Recast.

Many homeowners may be familiar with mortgage refinancing as a way to change the terms of a loan, whether that’s to obtain a lower interest rate, convert an adjustable rate to a fixed rate, shorten the length of the loan, or even unlock cash from equity.

To be sure, refinancing can be a useful tool for some homeowners. Refinancing may be helpful for finding a lower interest rate, shortening the term of a mortgage, switching from an adjustable interest rate to a fixed rate, or for tapping into the home equity for events such as consolidating debt.

But there are times when a homeowner may not need all the features of a refinancing, which is essentially taking out a new loan to replace the original loan and may involve all the complicated elements of qualifying for a new loan, including an origination fee, credit check, property appraisal costs, income verification, and other steps.

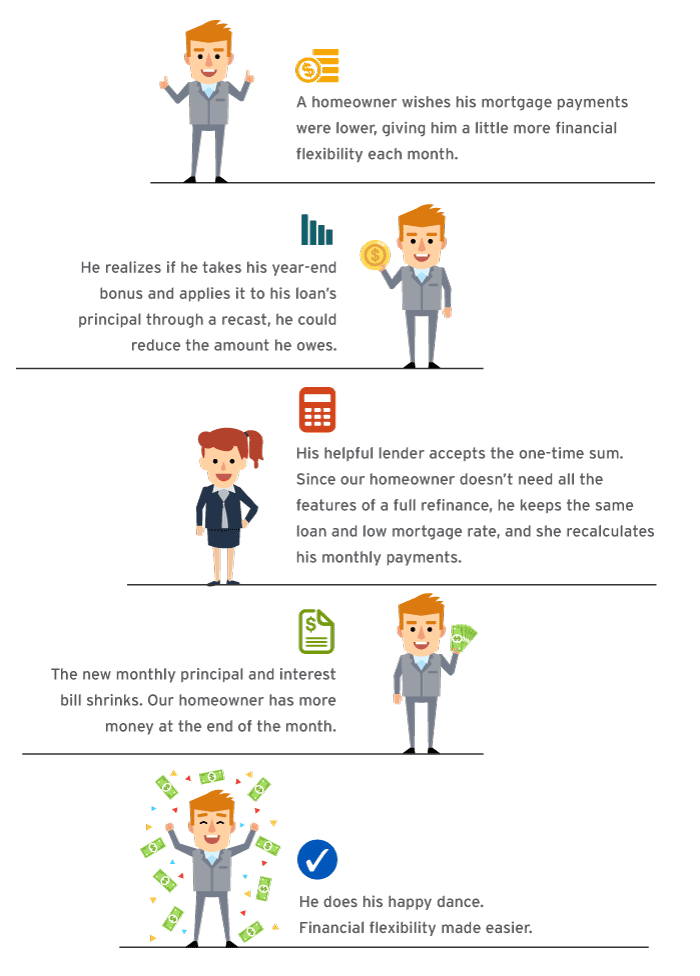

For those who don't need everything offered through refinancing, there's an alternative that allows homeowners to lower monthly payments with fewer steps and costs: recasting.

What exactly is a recast?

With a recast, a homeowner keeps their original loan terms (interest rate and maturity date) but makes one or more extra payments to principal to reduce the outstanding loan balance. The lender then recalculates the monthly payment based on the lesser principal owed.

With less owed, the loan continues at the same interest rate, same terms and conditions, but lower monthly principal and interest payments. Realtor.com calls the process "way easier than refinancing."

As well-known Certified Financial Planner, blogger, and speaker Michael Kitces explains, "By recasting the mortgage – re-amortizing the loan balance of the original term – the borrower enjoys immediate relief in the form of lower future mortgage obligations."

Here's an example. If a homeowner owes $200,000 with 25 years to go on a mortgage, the monthly interest and principal payment, at a 4.5% interest rate, would be $1,111.67. By making a $10,000 payment to principal, the principal is reduced to $190,000 and, with the loan's terms unchanged, the new monthly interest and principal payment would be $1,056.08, or $55.59 less … every month for the life of the loan. A payment calculator can help estimate future payments.

Recasting a loan isn't for everyone, like refinancing, it's a tool that has its uses. But for qualified homeowners with eligible loans who want to reduce their monthly payment and don't need all the features offered by refinancing, a recast can provide a straightforward solution. Learn more about recast eligibility and conditions here.