When the Earth Eats Your Home

When the Earth Eats Your Home

If you're required by your lender to have property insurance (and it's probably a good idea to have that protection anyway), you may want to check to see if you're fully protected.

Emergency or Bump in the Road? Your choice.

Emergency or Bump in the Road? Your choice.

Your car breaks down. You slip on a patch of ice and break your wrist. The refrigerator dies (two days after you had to call a plumber for a busted pipe). Unexpected expenses happen. And they can stress even a carefully planned budget if there's no "cushion" to fall back on.

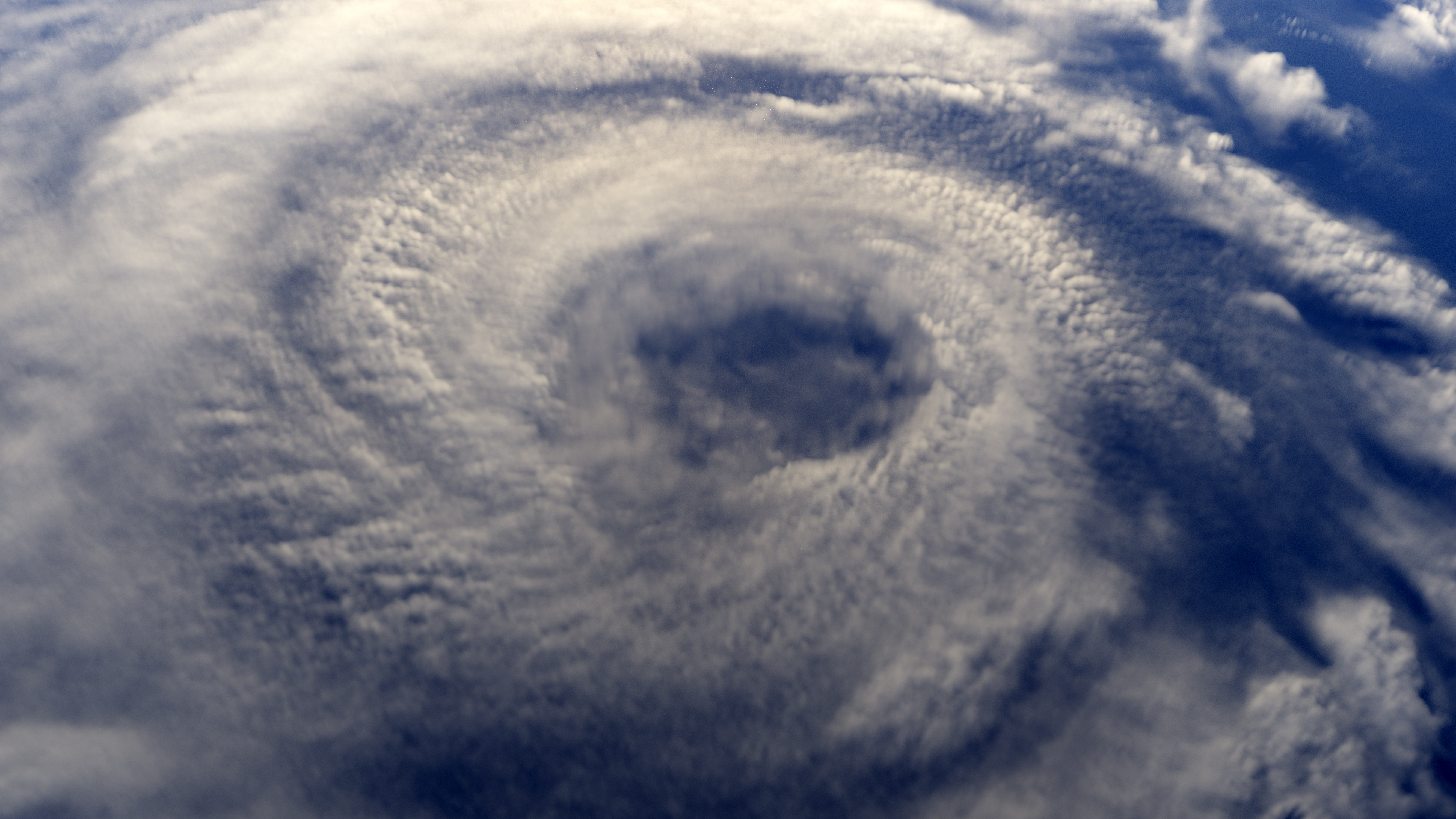

Hurricanes and Your Home: Prepare for the Worst, Hope for the Best

Hurricanes and Your Home: Prepare for the Worst, Hope for the Best

Few events bring on more destruction and disruption than a hurricane. As a homeowner, you can't stop the howling winds, but you can prepare.

Oh, Baby! Adjusting Finances for a Growing Family

Oh, Baby! Adjusting Finances for a Growing Family

A new addition to the family can be a joy. But if you’re already on a tight budget, you should understand the financial impact children can make. The federal government estimates the cost of raising a child in a middle class family to age 17 is more than $230,000.

Lower your monthly payments without refinancing? Recast.

Lower your monthly payments without refinancing? Recast.

Many homeowners may be familiar with mortgage refinancing as a way to change the terms of a loan, whether that’s to obtain a lower interest rate, convert an adjustable rate to a fixed rate, shorten the length of the loan, or even unlock cash from equity. But there are times when a homeowner may not need all the features of a refinancing.